Performance, through every cycle.

"Endurance beats timing"

Performance, through every cycle.

Founding Partner

Tyler Resch is a senior member of the Portfolio Management and Operations teams at Le Mans Trading. Mr. Resch plays a key role in the firm’s investment process – In this capacity, he works alongside other senior leaders to identify and vet top-tier trade talent while overseeing the day-to-day management of the firm’s portfolios.

Mr. Resch helps both retail and institutional clients build well- balanced, diversified, and non-correlated portfolios. His insights into alternative investments and portfolio management have been featured in numerous financial publications, including The Wall Street Journal, CTA Intelligence, and Commodities Now.

Before launching & Le Mans Trading LLC, Mr. Resch was a Commodity Trader at Lind-Waldock. As part of a team of traders, he was responsible for trading liquid contracts with a focus on systematic trading. In March of 2015, Mr. Resch co-founded IASG Alternatives LLC, a boutique broker dealer offering hedge funds and managed futures funds to qualified investors.

Founding Partner

JonPaul Jonkheer is a senior member of the Portfolio Management and Operations teams at Le Mans Trading. Mr. Jonkheer works closely with our trade teams and partners to ensure our firm is operating at peak efficiency and that all trading activities are aligned with the firm’s strategic objectives.

In March of 2015, Mr. Jonkheer co-founded IASG Alternatives LLC, a boutique broker dealer offering hedge funds and managed futures funds to qualified investors.

Mr. Jonkheer insights into the managed futures industry have been featured in leading financial publications and online outlets, including The Wall Street Journal, Michael Covel, and CTA Intelligence. Prior to joining IASG & Le Mans Trading LLC, Mr. Jonkheer has spent over 12 years as a sales and marketing executive.

Director of Investor Relations

Mason Resch operates Le Mans Trading’s Investor Relations and serves as the primary point of contact for all existing US & Non-US prospective investors. In that capacity, Mr. Resch spearheads various business development partnerships for the firm in collaboration with Le Mans Trading Management.

Mr. Resch oversees the firm’s comprehensive marketing initiatives, ensuring transparency and driving thought leadership across all channels. Mr. Resch collaborates with the Portfolio Management team to guide sophisticated investors through the complexities of alternative investments and managed futures.

Risk Manager

Mark W. Adams serves as the Risk Manager for Le Mans Trading LLC, where he oversees the firm’s integrated risk management framework. He is responsible for monitoring market and liquidity risk across all strategies, enforcing strict risk limits, and contributing to capital allocation decisions through quantitative analysis. Mr. Adams is also a Portfolio Manager for The Hyperion Fund LLC, a registered CPO and NFA member.

Previously, he was the Assistant Portfolio Manager and Chief Quantitative Officer for Warrington GP, an affiliate of Warrington Asset Management, which he joined in 2002. His career began in the Management Analyst Program at the Federal Reserve Bank of St. Louis.

Mr. Adams holds a BBA with a triple major in Finance, Management, and International Business from Washington University in St. Louis and an MBA from Southern Methodist University’s Cox School of Business. He maintains Series 3, 7, 30, 31, 63, and 65 licenses.

Portfolio Manager

Willy Snellen is a Senior Portfolio Manager responsible for trading the intraday derivatives contrarian strategy.

Willy has been trading the financial markets since 1988. After earning his Bachelor degree at Nijenrode University in the Netherlands in 1987, Willy started his career as a Foreign Exchange Trader at Banque Nationale de Paris Amsterdam, followed by Citibank in Frankfurt.

In 1998 Willy founded a proprietary trading company, in which he invested own capital combined with funds from two other trading companies. His trading style is based on a contrarian (mean reversion) strategy, with special focus on intraday derivatives trading.

Accounting & Compliance Manager

Colette Burke assist Le Mans Trading and our third party affiliates with our financial reporting, fund audits, and regulatory compliance to ensure accuracy and transparency for our investors.

Previously, Colette was an accounting associate at Knight Capital Group, a full-service Futures Commission Merchant that provided execution and clearing services in listed futures and options on all major exchanges. Before that, she was a brokerage execution specialist at Penson Futures and an operations and accounting manager at Chicago Futures Group, a futures and options execution firm for floor traders at the Chicago Mercantile Exchange.

Colette holds a B.S. in Business Administration from Illinois State University. She is a member of Women in Listed Derivatives (WILD), a global organization dedicated to the advancement of women in the derivatives industry.

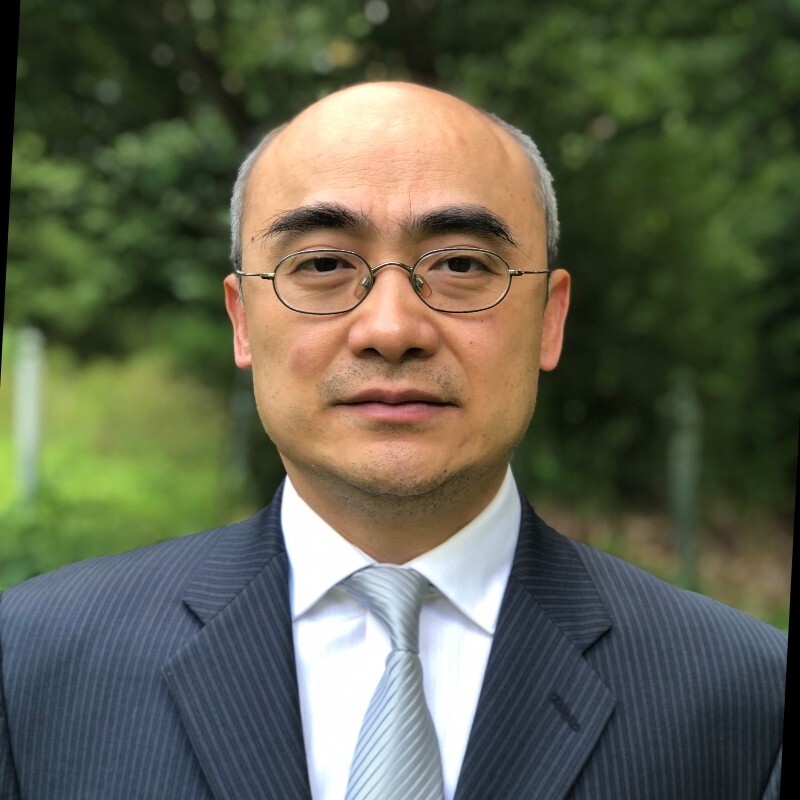

Portfolio Manager

Jiangtao Du is the Principal and Portfolio Manager for the Directional Spread Strategy. Mr. Du graduated from the University of Science and Technology of China in 1992 with a B.S & Computer Science Degree. Mr. Du continued his education at Harvard University, where he graduated with a PhD in Statistics/Cognate Field: Finance in 1998.

Mr. Du began his career as a portfolio manager in 1998 at JPMorgan Chase. After leaving JPM Chase in 2006, Mr. Du went on to spend the next 7 years as a portfolio manager and analyst, with firms Deutsche Bank, Capula Investment Management, and TD Securities. In 2013 Mr. Du decided to take his experience from these firms and ultimately create the Directional Spread Strategy. Mr. Du has managed or been an active participant in $2 billion of alternative investment assets throughout his career to date.

Portfolio Manager

Scot Billington is the Principal and Portfolio Manager for the Volatility Capture Strategy. Mr. Billington worked as an assistant trader for Bradford & Co., Incorporated, a Futures Commission Merchant (FCM) and division of J. C. Bradford & Co. from July 1993 until May 1999 when he began forming CCM. At J.C. Bradford he was responsible for executing client orders, advising clients, and developing systems.

Beginning in April of 2002, Mr. Billington worked for Ronin Capital, an Option Trading Investment Company at the Chicago Board Options Exchange where his main function was making markets in the OEX 100 Index options market. Mr. Billington was a member of the Chicago Board Options Exchange and a Market Maker at Ronin Capital in OEX 100 Index options until January 4, 2005.

Portfolio Manager

Maik Kaminski is a Senior Portfolio Manager responsible for trading and developing the Aquantum Active Range strategy.

Before joining Aquantum in January 2021, Maik held various positions at CCPM AG Group, where he was also one of the main shareholders. During this time, Maik developed, among other things, the “Athena” options strategy, which has been actively traded since 2002. From 2003 to the beginning of 2005, Maik was also responsible for implementing the risk management systems, which were programmed according to his specifications.

In 2012, Maik moved to the Supervisory Board of CCPM AG, where he served until 2019. Since the end of 2015, Maik has been working on new options-based trading strategies, mainly on the basis of the S&P 500.

Maik trained as a banker at Sparkasse Hagen and holds a US Series 3 license and the Eurex Trader certificate.

Portfolio Manager

Mr.Grubman is a seasoned Portfolio Manager at Le Mans Trading LLC.

With over nine years of experience in trading equity index and commodity derivatives, Cole brings deep expertise and a proven track record to the firm. His professional career includes notable roles such as a Trader at Belvedere Trading, a leading proprietary trading firm in Chicago, and an Index Derivatives Trader at IMC Trading, where he honed his skills in managing complex derivative strategies.

In 2023, he launched his own firm, Grubman Capital, Inc., focusing on trading equity index and agricultural commodity options. Cole holds a Bachelor of Science in Economics with dual concentrations in Finance and Legal Studies from The Wharton School at the University of Pennsylvania. His wealth of experience and dedication to delivering results make him a key asset to Le Mans Trading LLC

Portfolio Manager - Bowmoor Global Alpha Aggressive Fund

Brendan Mulvany is an experienced Head of Execution, with over 30 years of trading experience.

Brendan started his trading career with Dresdner Bank and Bank of America, specialising in the derivatives, futures and options markets. This led to Brendan building highly successful trading operations at the forefront of the investment industry, from the trading floor of the LIFFE EXCHANGE, to the desks of member firms KYTE FUTURES, REFCO, GHF FUTURES and MAREX.

As Head of Execution, Brendan leads all aspects of the Global Alpha strategy implementation.

Portfolio Manager - Bowmoor Global Alpha Aggressive Fund

Gareth is a mathematician by profession and passion and is a Fellow of the Institute of Mathematics and its Applications (FIMA). Gareth has a trading, research and investment management career built over 20 years, reading pure mathematics at Glasgow and Strathclyde University.

Gareth started out his professional career in the City of London, heading up the derivatives desk at Duncan Duckett. He then joined Harmonic Capital Partners – a leading global macro hedge fund – where he was instrumental in its growth during that period from $10m to $250m in assets under management.

Gareth designed and developed the Global Alpha strategy from 2003 to 2006 and, as Investment Manager, continues to run the strategy and is responsible for its on-going research and development.

CEO- Bowmoor Capital

Richard is a former Military Officer with 21 years of experience serving in both the Royal Navy and Royal Air Force as a helicopter and fast jet pilot.

Having undertaken operational service in Iraq, Libya, Syria and Afghanistan, where he was involved in many multinational operations, Richard elected for a career change. He was selected for the Barclays Military Fund Management Scheme to fast track a career into fund management, but decided first to pursue his entrepreneurial interests, including co-founding a company specializing in providing homes for people with support needs and raising over £500 million for a REIT.

Richard holds a Bachelor of Engineering (BEng) (Hons) from Newcastle University. As CEO of Bowmoor Capital, Richard has a single-minded focus on providing investors with best in class returns with low risk and long-term yield.

Le Mans Trading products are designed to adapt quickly to various market conditions and find inefficiencies to capitalize from.

Le Mans Trading products assist investors looking to hedge against individual asset risks and capitalize on diverse market price movements.

Le Mans Trading products historically produce an uncorrelated return to traditional investment classes, this is subject to change.

Le Mans Trading products assist with diversifying across asset classes, and helps minimize adverse events' impact on ones portfolio performance.

By using our site, you are agreeing to comply with and be bound by the following Terms of Service Agreement. Please review the following terms carefully. If you do not agree to these terms, you should not use this site. The term “us” or “we” or “our” refers to Le Mans Trading LLC, the owner of the website. The term “you” refers to the user or viewer of our website.

1. Acceptance of Agreement.

You agree to the terms and conditions outlined in this Terms of Service Agreement (“Agreement”) with respect to our site (the “Site”). This Agreement constitutes the entire and only agreement between us and you, and supersedes all prior or contemporaneous agreements, representations, warranties and understandings with respect to the Site, the content, products or services provided by or through the Site, and the subject matter of this Agreement. This Agreement may be amended at any time by us from time to time without specific notice to you. The latest Agreement will be posted on the Site, and you should review this Agreement prior to using the Site.

2. Copyright.

The content, organization, graphics, design, compilation, magnetic translation, digital conversion and other matters related to the Site are protected under applicable copyrights, trademarks and other proprietary (including but not limited to intellectual property) rights. The copying, redistribution, use or publication by you of any such matters or any part of the Site, except as allowed by Section 3 below, is strictly prohibited. You do not acquire ownership rights to any content, document or other materials viewed through the Site. The posting of information or materials on the Site does not constitute a waiver of any right in such information and materials. Some of the content on the site may be the copyrighted work of third parties.

3. Limited License; Permitted Uses.

You are granted a non-exclusive, non-transferable, revocable license (a) to access and use the Site strictly in accordance with this Agreement; (b) to use the Site solely for your internal business or personal purposes; and (c) to print out discrete information from the Site solely for internal business or personal purposes and provided that you maintain all copyright and other policies contained therein.

4. Restrictions and Prohibitions on Use.

Your license for access and use of the Site and any information, materials or documents (collectively defined as “Content and Materials”) therein are subject to the following restrictions and prohibitions on use: You may not (a) copy, print (except for the express limited purpose permitted by Section 3 above), republish, display, distribute, transmit, or otherwise make available in any form or by any means all or any portion of the Site or any Content and Materials retrieved therefrom; (b) use the Site or any materials obtained from the Site to develop, or use as a component of, any information, storage and retrieval system, database, information base, or similar resource (in any media now existing or hereafter developed), that is offered for commercial distribution of any kind, including through sale, license, lease, rental, subscription, or any other commercial distribution mechanism; (c) create compilations or derivative works of any Content and Materials from the Site; (d) use any Content and Materials from the Site in any manner that may infringe any copyright, intellectual property right, proprietary right, or property right of us or any third parties; (e) remove, change or obscure any copyright notice or other proprietary notice or Terms of Service contained in the Site; (f) make any portion of the Site available through any timesharing system, service bureau, the Internet or any other technology now existing or developed in the future; (g) remove, decompile, disassemble or reverse engineer any Site software or use any network monitoring or discovery software to determine the Site architecture; (h) use any automatic or manual process to harvest information from the Site; and (i) use the Site in a manner that violates any state or federal law regulating email, facsimile transmissions or telephone solicitations.

At Le Mans Trading LLC, we are committed to protecting our clients’ privacy. We make the following pledge to our clients:

1. We will limit the collection and use of personal information to the minimum we require to administer our business and provide superior service to you. This information includes the data we receive from you on customer applications, forms completed on our website or other forms, such as your name, address, social security number, assets, income, investment objectives and experience and information about your transactions conducted through our firm, such as your account balance and net profit or loss. In accordance with Commodity Futures Trading Commission (“CFTC”) Rule 160.13, we may disclose all of the information we collect, as described above, to companies that perform marketing services on our behalf or to other financial institutions with which we have joint marketing agreements.

2. We may disclose nonpublic personal information about our clients and former clients as permitted under CFTC Rules 160.14 and 160.15. The law permits us to share this information with companies that perform services for your account, such as brokers who execute your futures transactions. The law also permits us to share this information with third parties acting on behalf of you, such as your IRA custodian or trustee.

3. We restrict access to nonpublic personal information about you to those employees, agents and service providers who need to know that information to provide services to you. We maintain physical, electronic and procedural safeguards that comply with federal standards to safeguard your nonpublic personal information.

4. The Le Mans Trading LLC website uses “cookies” to help you personalize your online experience. A cookie is a text file that is placed on your hard drive by a web page server. Cookies cannot be used to run programs or deliver viruses to your computer. Cookies are uniquely assigned to you, and can only be read by a web server in the domain that issues the cookies to you.

One primary purpose for using cookies is to save you time on the Le Mans Trading LLC website. A cookie’s purpose is to communicate to the web server that you have come back to a certain page. One example would be if you customize Le Mans Trading LLC pages, or register with the web site, a cookie will assist Le Mans Trading LLC in recalling your specific information on future visits. This simplifies the process of recording your personal information or preferences. When you return to the Le Mans Trading LLC website, the information you previously provided can be retrieved, so you can easily use the Le Mans Trading LLC features you personalized.

You have the ability to accept or decline cookies. Most modern web browsers accept cookies automatically, but you can usually modify your browser’s settings to decline cookies if you choose. If you elect to decline cookies, you may not be able to fully experience the interactive features of the Le Mans Trading LLC website.

This website utilizes Google Analytics to get aggregate metrics on website usage. Please refer to the following policies on Google’s website for more information:

Google’s Privacy Policy

Cookies & Google Analytics on Websites

Opt out of Google Analytics Cookies

In addition, we may advertise on the Google content network using Google’s remarketing technology. In doing so, Google will place or read a unique ad-serving cookie on your computer and will use non-personal information about your browser and your activity at this site to serve ads on their content network. The ad-serving cookie is a persistent cookie. You can visit this site to learn more about remarketing or to opt-out of the Google remarketing cookie.