As we bid farewell to 2023, it’s crucial to dissect the events and economic indicators that have shaped the stock market’s landscape in 2023, with a particular focus on the fourth quarter of the year. The fourth quarter has been a period of both challenges and opportunities, influencing investor sentiment and market dynamics.

2023 saw a mixed macroeconomic landscape. As it relates to the stock market, arguably the single largest driver of momentum is central bank policy. For better or worse, this theme will likely be even more prevalent in 2024, with investors pounding their fists and calling for rate cuts while the Federal Reserve toes the line between managing inflation and not constricting the economy too tightly.

Central banks play a pivotal role in shaping the dynamics of the stock market through their monetary policy decisions and actions. By setting benchmark interest rates, central banks can impact borrowing costs for businesses and consumers. For example, lowering interest rates can stimulate economic activity and boost stock prices as it becomes cheaper for businesses to borrow money for expansion or investment. Conversely, raising interest rates can cool down an overheating economy, but it may also lead to higher borrowing costs and potentially impact stock valuations.

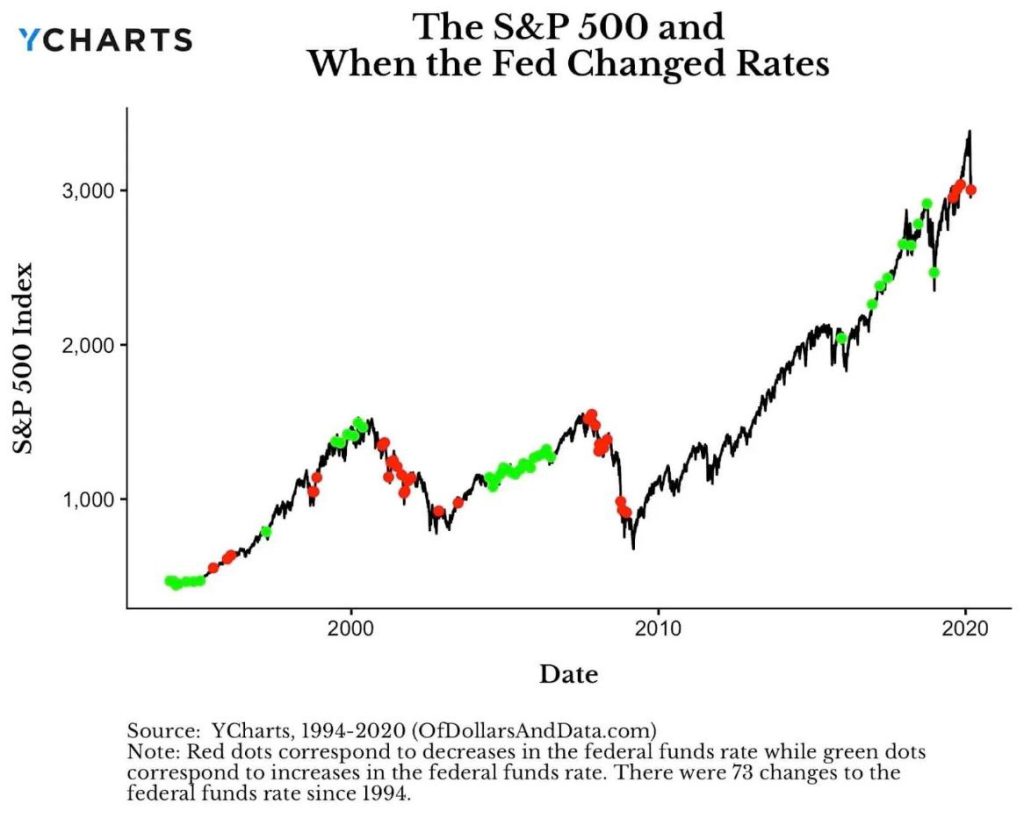

It is important to look at historical market reactions to Fed decisions. Although a rate cut may be typically considered bullish, as described above, the market tends to front-run these anticipated decisions and then have a strong counter-reaction to the actual announcement. The chart below illustrates this well, focusing on the cuts (red dots) and the ensuing market drop.

The history of stock market crashes following Federal Reserve (Fed) interest rate cuts is complex and influenced by various factors.

Here are a few instances in history where stock market crashes occurred despite Fed interest rate cuts:

Black Monday (1987): The Federal Reserve had implemented interest rate cuts leading up to the crash on October 19, 1987. However, these cuts did not prevent the significant market decline on that day.

Dot-com Bubble Burst (2000): The Fed had lowered interest rates in response to the bursting of the dot-com bubble, but the stock market still experienced a significant decline. The Nasdaq Composite Index, which was heavily influenced by technology stocks, suffered substantial losses.

Global Financial Crisis (2008): The Fed implemented a series of interest rate cuts in 2007 and 2008 in response to the subprime mortgage crisis. However, these actions did not prevent the subsequent severe global financial crisis, which included a substantial stock market decline.

COVID-19 Pandemic (2020): In response to the economic fallout from the COVID-19 pandemic, the Fed cut interest rates to near zero in March 2020. Despite these cuts and other monetary measures, global stock markets experienced sharp declines in the early months of the pandemic.

It’s important to recognize that while interest rate cuts can be a tool to stimulate economic activity, they are not a panacea, and market reactions can vary based on the specific economic conditions and underlying factors at play.

Additionally, there are instances where interest rate cuts have coincided with market recoveries or mitigated the severity of downturns. The relationship between interest rates and stock market movements is multifaceted, and various economic indicators, geopolitical events, and market sentiment also play crucial roles.

Beyond monetary policy, the stock market often reacts to anticipated policy changes, especially in areas such as taxation, regulation, and fiscal policies. All of these will be pertinent during the upcoming US Presidential election. Although a smooth and predictable election process can contribute to market stability, recent history makes this unlikely. Uncertainty or contentious elections may lead to increased volatility, which seems more likely. This, among other unknown catalysts, will certainly make for an exciting trading year ahead.

Focusing more specifically on our fund and our roster of traders.

Areas of strength in 2023

Credit Risk Diversification: Risk management is paramount to everything we do at Hyperion Fund, and part of that consideration is our credit risk with our clearing firms. Although nothing has been uncovered to cause any concern with our existing clearing relationships, we have added two top-tier global futures clearing merchants to our list of vendors. You can view and learn more about both firms here:

Marex

ADMIS

Investment Strategies: Let’s take a look at the performance drivers for 2023.

Directional Spread Strategy: Utilizing the combination of moderate volatility and some equity back and forth to record a significant profit in 2023. During market declines, we capitalized on the market’s steady drop by realizing profits through a series of ratio put spreads. This led to net monthly returns by holding short-term positions across various expirations and consistently harvesting small gains. In months where there was an absence of downside movement, the continued upward trend limited the potential for ratio put spreads to yield significant profits. In these environments, we persist in collecting credits for the spreads, enabling a modest degree of profitability.

Tactical: The lack of severe downside trading allowed for the various credit put spreads in the portfolio to expire profitably. By diversifying positions across multiple expiration dates, we steadily accumulated profits, resulting in a net profit. The relationship between options drives spread-based trades. These trades, rather than outright option sales, continue to be more lucrative in 2023. While a slightly elevated VIX would present more trading opportunities, we continue to identify appealing positions. Even in a low-volatility environment, we have been able to consistently identify attractive credit spreads, achieving returns consistent with the fund’s long-term historical performance.

Risk Sigma: This is a short-term “mean reversion” trading program focused on S&P 500 Futures and Options. Its average holding period of 5-7 days held true in 2023. A shorter trading time frame and higher turnover seek to reduce program volatility exposure and drawdowns, which was the case in 2022 but were less required in 2023. The program is model-driven, seeking to generate returns from both volatility and directional markets. The strategy is generated by rigorous mathematical and quantitative models following the ebb and flow of market actions, we not only look at absolute returns but also focus on risk adjusted returns. As with all of our strategies, positions were stopped out of at a loss at times throughout the year but ultimately more than overcame these losses through profitable trading.

Corporate Updates: There have not been any changes to the ownership structure and leadership of the managing member. Myself (Tyler Resch) and my partner JonPaul Jonkheer continue to be the two principals in charge of day-to-day operations and portfolio management. Our Director of Investor Relations, Mason Resch, continues to help guide investors and provide education. Our seven primary Portfolio Managers continue to manage the individual strategies of the fund and are some of the most cognitively astute and meticulously detailed individuals I have ever had the honor of working with. I encourage all investors to spend time looking at their individual bios in our marketing material, as our team has always been the most robust element in making Hyperion Fund a unique offering in a competitive landscape. Our administrator and auditor are unchanged, and we just recently finished our regulatory audit via the National Futures Association without any material findings.

Areas of Weakness in 2023

Volatility Capture Strategy: In a year without significant volatility, our “Capture” strategy will, by definition, have nothing to capture. The VIX, or Volatility Index, is designed to measure the market’s expectation of future volatility over the next 30 days. However, there can be instances where the VIX may not reflect volatility as expected. In periods of extended market calm or complacency, investors may underestimate the potential for future volatility. As a result, the VIX might remain relatively low, not fully capturing the latent risks. Structural changes in financial markets are also a determining factor. The rise in popularity of short-dated options can also influence how the VIX responds to market conditions. The strategy overall did not divert profits although it failed to generate a material gain either. In a year like 2023, that is not a bad outcome. We are trying to capture large downside movement with this strategy and not take significant losses if the collapse never materializes.

Communication: Although we send out our monthly letter accompanied by the most recent performance, I know there is more education that we can provide. Whether it be tax treatment, investment process, or accessibility, if you have anything that you would like to hear more about, please let us know. We would be grateful for any feedback and will be quick to execute any suggestions we are given.

Conclusion: In closing, as a firm, we are proud of what we have accomplished in 2023. We have maintained a negative correlation to the S&P 500, returning positive performance in both negative and positive equity market environments. Our Sharpe ratio, a widely used metric in finance that measures the risk-adjusted return of an investment or a portfolio, sits at 3.02, which is considered quite high. We have not had a negative month in over 3 years, and in 2023 we exceeded our 9-10% expected target with an 11% return for the year.

On a more personal note, as I sat with my wife on New Year’s Eve, kids in bed, the house finally quiet, and I had a moment to reflect on the year just passed, I could not help but be overcome by the deepest gratitude I have felt in my professional life. Our investor base is filled with some of the best that mankind has to offer. The unwavering support and confidence in what we have built continue to floor me. The trust in our vision and commitment to excellence has been a driving force behind our successes. Their continued confidence in our endeavor has not only contributed to the growth but has also played a pivotal role in shaping the positive trajectory of 2024.

We recognize the significance of your investment and are genuinely thankful for your belief in our team and the opportunities we pursue. Once again, thank you for being a valued and loyal investor. We look forward to many more milestones and successes together.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING COMMODITY INTERESTS CAN BE SUBSTANTIAL. YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY INTEREST TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF LEVERAGE CAN LEAD TO LARGE LOSSES AS WELL AS GAINS. IN SOME CASES, MANAGED COMMODITY ACCOUNTS ARE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT AND ADVISORY FEES. IT MAY BE NECESSARY FOR THOSE ACCOUNTS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS.